Contents

- Introduction

- Critical Information required for Solvency II calculations

- One Year Risk Horizon

- Ultimate Year Risk Horizon

- Consistent estimates of prior accident year ultimates and Solvency II metrics on updating

- IFRS 4 Phase II

- Variation in estimates of prior accident year ultimates, conditional on the next calendar year

- How to use ICRFS-Plus™ to fulfil Solvency II requirements

- Further Reading

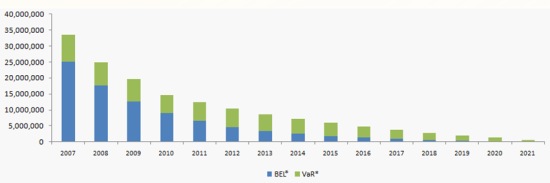

Risk Capital (RC), Ultimate Year Risk Horizon and Market Value Margin (MVM)

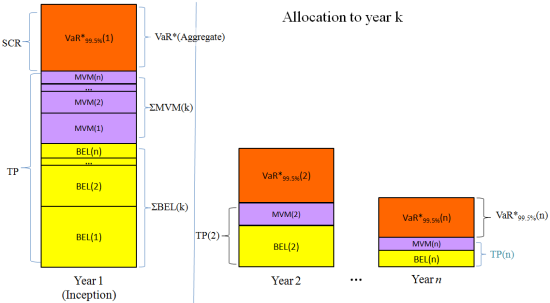

With the ultimate year risk horizon, risk capital is sufficient to cover adverse development up to a certain (e.g. 99.5%) quantile in the predictive aggregate loss (reserve) distribution for the whole run-off period. The entire risk capital, that is, Value at Risk for the aggregate reserve (VaR(aggregate) = VaR*(1)) is raised at inception and released back to the capital providers at the end of each calendar year. At the beginning of calendar year k (for k>2) the amount of risk capital retained for the remaining run-off period is VaR*(k). The amount of risk capital released back to the capital providers at the end of calendar year k (for k=1,...,n) depends on the total loss in year k, the mean loss for year k, risk capital VaR*(k) (retained at the beginning of year k), and risk capital VaR*(k+1) (retained at the beginning of year k+1).

Note that the principal difference between the one-year risk horizon and the ultimate risk horizon in respect of computing RC and MVM is when capital is raised from the capital providers (and not when it is released back to the capital providers).

The above figure assumes the loss L(k), if exceeding the mean loss, is below RC(k) = VaR*99.5(Lk) - VaR*99.5(Lk+1).

In the RC and MVM calculations PDF we discuss RC, MVM and the cost of capital approach for the ultimate risk horizon. There is also a description on how ICRFS-Plus™ calculates ultimate risk horizon metrics for the aggregate of multiple LOBs for a given MPTF model and an associated forecast scenario.

Consistent estimates of RC and MVM both for one-year and ultimate risk horizons on updating

In the section on Consistency and Updating, conditions for consistency of prior (accident) year ultimates on updating are discussed. It is mentioned that only models and forecast assumptions based on the PTF and MPTF modelling frameworks achieve the necessary conditions of consistency on updating.

Under the same conditions RC and MVM calculations are also consistent on updating from year to year. For example, if a forecast scenario assumes a calendar trend of 10% +- 2% for next calendar year followed by 5% +- 1% thereafter, then, RC and MVM are consistent on updating one year hence provided the next year's observed paid losses falls on the assumed 10% +- 2% trend line and the subsequent calendar trend is set to (assumed to be) 5% +- 1%.

Note that for a long tail liability LOB the parameter uncertainty reduces on updating as the model is re-estimated with more data.

Fungibility of Lines of Business and Calendar Years

By default, we assume that the Lines of Business are fully fungible. That is, a surplus in one LOB can supplement a deficit in another LOB. In practice, this is not necessarily the case for legal or other reasons. Thus, we provide additional options to describe fungibility as follows:

- All lines are fungible, calendar years going forward are fungible (default in ICRFS-Plus™)

- Lines of business are not fungible, calendar years going forward are fungible

- All lines are fungible, calendar years are not fungible

- No fungibility either by Line of Business or by calendar year

The above options are important as they describe the level of diversification afforded for writing multiple Lines of Business - for MVM and Risk Capital. Fungibility applies to the risk capital fund and whether surpluses supplement the risk capital fund (which lowers the required risk capital) or whether the risk fund has to stand on its own.

For more details, see the section on IFRS 4 Phase II.